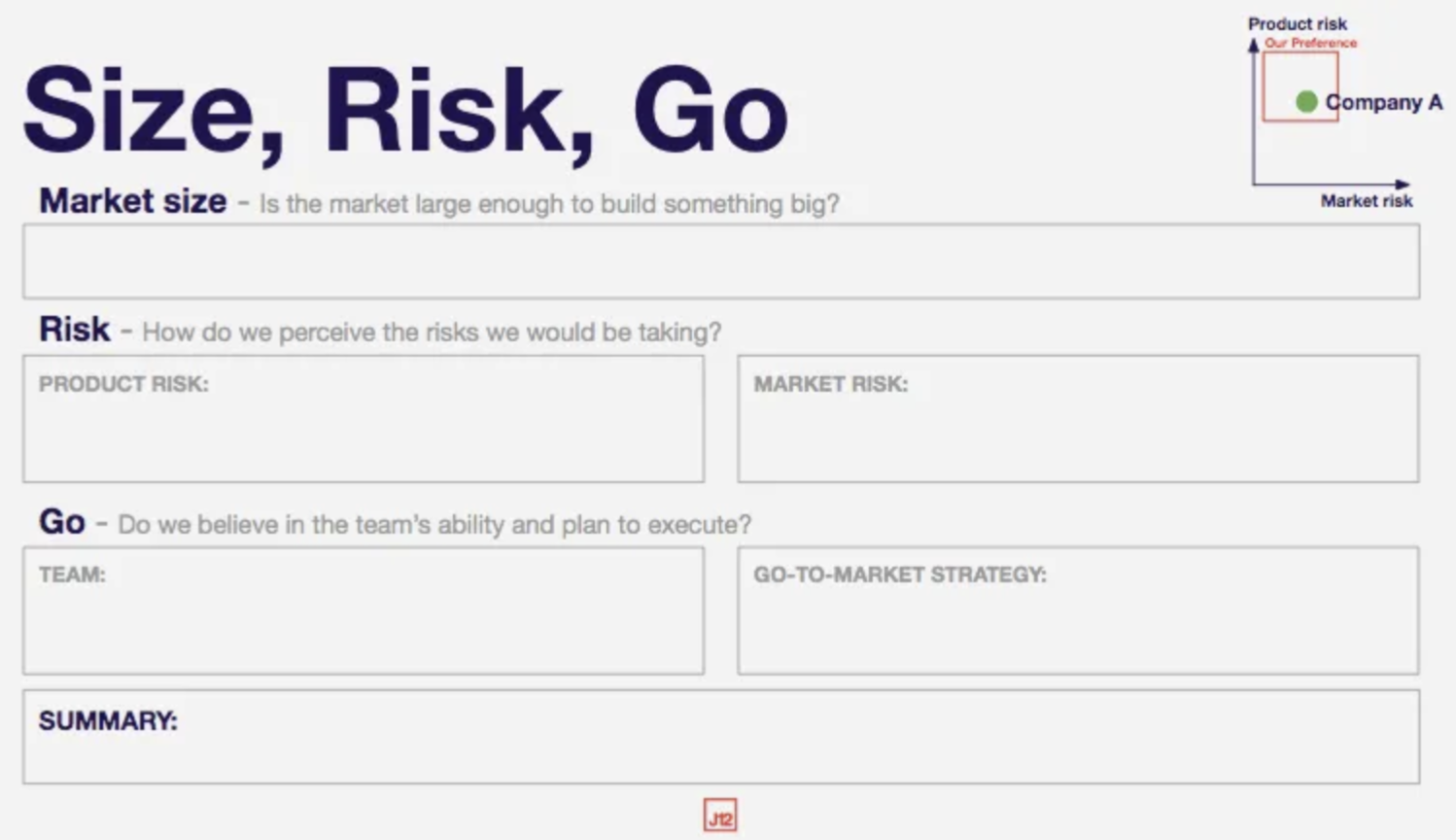

Size, Risk, Go: Our model for Selecting the Top 0.5% of Companies

The billion-dollar questions we are often asked:

From founders, “What do you look for in a startup?”

From investors, “How do you identify investments from the 1000+ companies you encounter each year?”

The answer is ‘Size, Risk, Go’

The answer to those questions lies in the image above. It shows the graphical depiction of our ‘Size, Risk, Go’ model, scribbled on a whiteboard in a recent internal investment meeting. Of course, a complete answer would also detail things such as how we leverage the expertise of our angel group when looking at cases, how we conduct due diligence, or the structure of our investment committee. However, having a framework upon which to form and build an analysis of cases, as well as around which to inform and discuss internally, is a vital component.

Over the last few years we’ve taken various approaches towards this, and, as a result of approximately 500 meetings with startup founders and hundreds of internal discussions, now more than ever we have an analytical framework that is as highly simple as it is widely comprehensive, and is useful because it does the three things that any good model needs to do well:

It focuses on the key factors

It points the direction towards further analysis

It is communicable and provides a common language

…

First, a quick look at other frameworks

All investors talk in similar terms with regards to what they look at when evaluating a company, highlighting the importance of the team, market size, product, timing, understanding the SWOT analysis, etc… A great example can be seen in this fantastic article shared by Creandum’s Fredrik Cassel which includes the one-slide analysis of Spotify they used internally before deciding to lead the company’s first institutional round.

From our experience, though, tabulated summaries such as these, or other approaches that present the analysis of one element at a time, treat each factor (e.g. team, market) too independently. This is problematic as each case is, in fact, a combination of moving parts where the strength or weakness in one area will affect the strength required in another, and such frameworks fail to inherently recognise that interconnectedness or create those links. Thus, while focusing on the key factors, they fail to build the kind of holistic view that best identifies where further analysis is required. Furthermore, by isolating factors rather than bringing them together, it becomes harder for multiple team members to discuss and debate the same case.

…

Size, Risk, Go

The key elements within the model are not too surprising and don’t differ greatly from those mentioned above, with the differentiation rather being in how they are packaged together.

Size

Is the market large enough to build something sufficiently big? How do we view the addressable/obtainable market? What growth rates and assumptions do we pay attention to?

…

Risk

How do we perceive the risks that we would be taking?

Product Risk

Identified as a combination of technical product risk and operational product risk. With the aim to understand the degree of complexity involved in delivering the product or service in question.

Market Risk

With the aim to understand whether there is clear/sufficient demand for the product or service being offered. Looking at the competition, market dynamics, timing, traction, user/customer feedback, etc.

…

Go

Do we believe in the team’s ability and plan to execute?

Team

How do we perceive the team-product-fit, the team-market-fit? What are the ‘soft’ characteristics of the founders? How are the core team dynamics?

Go-to-Market

How well do they know their market, potential customers, customer segmentation, pricing & business model, plan & channels through which to reach and sell to customers / acquire users?

…

It points the direction towards further analysis

Investment decision-making is an active process of understanding what needs to be understood. Figuring out what the opportunity is that we would be betting on, gaining clarity over the risks that we would be taking, and understanding to what extent we believe the team can seize the former and overcome the latter.

Thus, any analytical model has to be dynamic in its ability to lead the navigation of this process. For example, if it is quickly apparent that there is a significant degree of market risk, greater emphasis must then be put on understanding how the team can overcome those market-related challenges — are they uniquely placed in addressing the market? Or if the size of the market is on the small side, do elements related to timing, dynamics, and a strong go-to-market approach give them an advantage towards taking a large part of it?

There are no hard rules or fixed lines when looking to identify rare opportunities for outsized returns. Therefore every factor is simply something that relates to other factors and must be understood not only by itself but within the wider context. The way we can relate points to each other, and map them simply in an overall view, enables the quick identification of key questions and areas of further interest.

…

It’s communicable and provides a common language

If investment decision-making is a process of understanding, it is just as much a process of debate and disagreement. Consensus-driven investments tend to be on the low-risk low-reward end of the spectrum, so we welcome opposing views and it is, therefore, important to be able to discuss, challenge, and see where differences of opinion lie.

Not only can we analyse all the many underlying factors, but we can combine them in a way that allows us to illustrate an entire investment case in one dot on a graph. This data point is by no means final, but rather serves as the focal point for discussion, enabling us to argue over the details while retaining a view on how they affect the bigger picture.

In short, we have a preference for investing in exceptional teams, extremely well-fitted to a product that is difficult to build and a market that is both very large and very clear. In other words, we like big dark green bubbles positioned towards the top left corner of the graph. But many great investment opportunities don’t look quite like that, particularly at such an early stage as when we look to invest. Teams require strengthening and developing, markets require greater understanding, and barriers around the product require time to develop.

…

To sum up

With this framework, we form an overall view of the risk/reward profile by relating three questions to each other:

Is the size of the opportunity large enough to carry the identified risks?

Do we understand, and are we comfortable with, the risks?

Do we back this team, and their plan, to execute?

However, as much as it is an analytical framework, it is an approach that enables us to understand better what it is that we need to understand better, if we are to back a company in the first place and support it in the right ways thereafter.